Have you noticed how everyone who's anyone in Fake News and Quackademia is now blaming the breakdown of the "Global Supply Chain" ™ for the ever-worsening inflation we are experiencing? The snarling of the "Global Supply Chain" ™ -- the "experts" say -- coupled with increased post-lockdown "pent up" consumer demand -- has caused shortages and slowed deliveries. More demand AND less supply equals higher costs. Simple economics, right? Well, if that's the case, then it should mean that as soon as demand stabilizes whilst we manufacture more stuff -- we will see the prices of our steaks, eggs, milk, toothpaste etc. all drop just as rapidly as they've gone up in recent months, right? (rolling eyes sarcastically).

Yenta Yellen (cough cough) - Treasury Secretary & former Fed Chair - reassures us:

"On a 12-month basis the inflation rate will remain high into next year, but I expect improvement (in the rate) by the middle to the end of next year – second half of next year."

Key word: "rate." -- You see, though the rate of inflation may come back down to an "acceptable" 2% (don't bet on that either), the already "baked-into-the-cake" price increases will never roll back. That's because the problem with the "Global Supply Chain" ™ (a big factor of which has to do with California's crazy anti-trucker laws) has got NOTHING to do with the debasement of our currency's value. The "powers that be" understand this very well -- but because their counterfeiting / loan sharking / market rigging crime syndicate that is the Federal Reserve System must be protected at all times and at all costs, "they" want you to believe that our current inflationary woes are mainly the result of some esoteric bullshit linked to the "Global Supply Chain." ™

Yenta Yellen (cough cough) - Treasury Secretary & former Fed Chair - reassures us:

"On a 12-month basis the inflation rate will remain high into next year, but I expect improvement (in the rate) by the middle to the end of next year – second half of next year."

Key word: "rate." -- You see, though the rate of inflation may come back down to an "acceptable" 2% (don't bet on that either), the already "baked-into-the-cake" price increases will never roll back. That's because the problem with the "Global Supply Chain" ™ (a big factor of which has to do with California's crazy anti-trucker laws) has got NOTHING to do with the debasement of our currency's value. The "powers that be" understand this very well -- but because their counterfeiting / loan sharking / market rigging crime syndicate that is the Federal Reserve System must be protected at all times and at all costs, "they" want you to believe that our current inflationary woes are mainly the result of some esoteric bullshit linked to the "Global Supply Chain." ™

1. Supply chain problems actually make a good case for the U.S. (& all nations) to change their over-reliance on the "global economy" and make more stuff at home, closer to the actual markets. // 2. California's recently enacted labor and "green" restrictions adversely impact independent truckers -- many of whom no longer wish to pick up hauls at California ports. // 3. The record backlog of container ships at California ports has got nothing to do with the "Global Supply Chain." The stuff is arriving in port but there aren't enough truckers present to quickly unload the containers, deliver them all, and then return the much-needed containers for reuse.

The nonsensical article repeats the fallacy about "higher manufacturing costs" and "increased labor costs" having to be passed onto customers in the form of final retail inflation. That's like saying that wet sidewalks are causing the thunder storms. Price inflation is actually caused by the Federal Reserve's never-ending infusions of debt-based currency into the economy. This is being done via the banking system (residential & commercial real estate & mortgage refinance boom) and also through direct loans (bond purchases) to the government (Covid-related "stimulus," payments to hospitals and individuals etc.) The bubble caused by this tsunami of credit had been previously limited to the stock and real estate markets -- but now, everything is being blown up. Been to the grocery store lately?

The eye-popping Monetary Base chart below was published by the Board of Governors of the Federal Reserve System. If "the paper of record" had any integrity, it would appear on its front page for all to see the obvious cause & effect linkage between the production of debt money to fund "Stupid-19" and the inevitable increase in prices. It is the simplest darn chart you'll ever see. Have a look -- a good look.

We don't know how much longer "the usual suspects" will be able to get away with blaming this frightening inflation on the Scamdemic's effect upon the "Global Supply Chain" ™. It truly is blood-boiling to have to read their blame-shifting bullshit. Here's a sample, from the article:

Slimes: The pandemic has disrupted nearly every aspect of the global supply chain — that’s the usually invisible pathway of manufacturing, transportation and logistics that gets goods from where they are manufactured, mined or grown to where they are going.

Rebuttal: "Every aspect" of the "Global Supply Chain" ™? Seems to this reporter that the only broken links are at the massive ports of California (and, to a lesser extent, certain east coast ports as well)-- yet not a single mention of the true causes of the unprecedented California backlog of nearly 500,000 essential containers!

Slimes: At the end of the chain is another company or a consumer who has paid for the finished product. Scarcity has caused the prices of many things to go higher."

Rebuttal: So, it is "scarcity" which is causing prices to rise, eh? The doubling of the monetary base (at interest!) has got nothing to do with it?

In that case, frick it! We should print even more debt money -- like (((they))) did in Wiemar Republic days. Let's just hope that the political turn of events which comes out of this looming crisis will be similar to that of Germany 1932 -- know what I'm sayin'?

Maybe something good will emerge from the coming "Dark Winter?" ... Hey, I can dream, can't I?

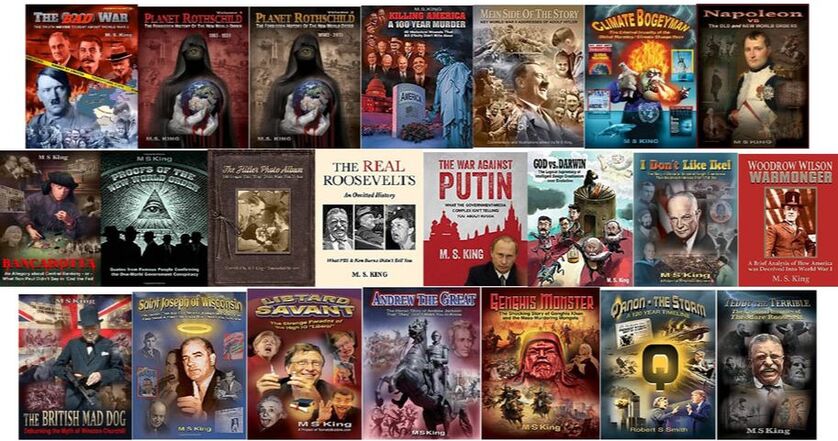

MIKE'S BANNED BOOKS & PDFS

DONATIONS

MIKE'S BANNED BOOKS & PDFS

DONATIONS

Boobus Americanus 1: I read in the New York Times today that disruptions in the Global Supply Chain are causing higher prices.

Boobus Americanus 2: Yes. Global Supply Chain ..... doing bad.

*

St. Sugar: Yet it doessn't ever occur to Boobuss to assk why inflation always creeps up, year after year, decade after decade since 1913.

Editor: Never has something that is so simple to understand -- when properly explained -- seemed so confusing to so many people.

|

FROM PROTOCOL 21

"When the comedy is played out there emerges the fact that an exceedingly burdensome debit has been created (for the state). For the payment of interest it becomes necessary to have recourse to new loans, which do not swallow up but only add to the capital debt. And when this credit is exhausted it becomes necessary by new taxes to cover, not the loan, BUT ONLY THE INTEREST ON IT. These taxes are a debit employed to cover a debit." |

**************

AUTO-MONTHLY DONOR / SUBSCRIBER OR 1-TIME OPTIONS

ALL 24 PDF BOOKS

PLUS the "almost-daily' Anti-NY Times

**************

AUTO-MONTHLY DONOR / SUBSCRIBER OR 1-TIME OPTIONS

ALL 24 PDF BOOKS

PLUS the "almost-daily' Anti-NY Times

**************

Click on "Donate Monthly" button below to quickly & securely sign up at SubscribeStar.

(Look for "Sign Up" in top right corner -- AND be sure to submit your e-mail)

*Allow a few daytime hours (USA EST time) to receive the pdf links.

*

For 1-Time Online Donation Option

(also with PDF rewards)

CLICK HERE

To send a check / MO or cash by mail: Payable to:

PASCAL PUBLICATIONS, P.O. BOX 804, SADDLE BROOK, NJ 07663